vipcool.ru

Market

Financial Consulting Rates

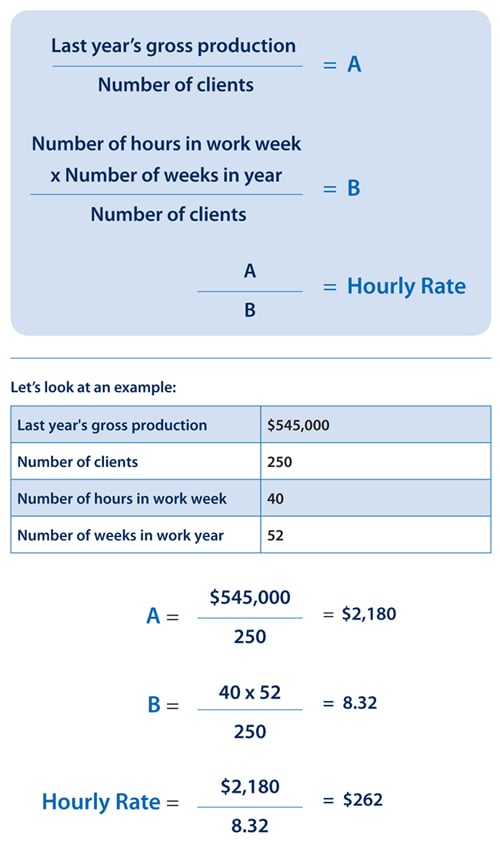

If you double this and round up to the nearest multiple of $5 or $10, your consulting rate should be about $80 an hour. ($ x 2 = $, rounded to $). Wells Fargo Advisors Fees vary by relationship type and services provided. Learn about investment advisory services, brokerage and related fees. Average Consulting Rates By Industry ; E-Discovery Consultant, $ – $ per hour ; Expert Witness Consultant, $ – $ per hour ; Risk Management Consultant. Their annual fee income can range from anywhere below $50, (R,) a year (for operational support) to above $, (R million for executive. Fee-only financial planning means % objective advice. It's just that simple. When you're making important financial decisions that will affect your future. Let's assume that the average market rate in the US is $50 per hour. A consultancy with just around five years in the business charges $ $30 per hour, while. So your cost on their books was $92k which means that you should at least ask for $44 per hour based on that. However, you are also not working. The average nonprofit consultant fee ranges from $$ per hour. Highly sought consultants can charge upwards of $/hour, while less experienced. 1. Hourly rate. The hourly fee is a common and simple way for independent business consultants and consulting firms to charge. · 2. Daily rate. If you double this and round up to the nearest multiple of $5 or $10, your consulting rate should be about $80 an hour. ($ x 2 = $, rounded to $). Wells Fargo Advisors Fees vary by relationship type and services provided. Learn about investment advisory services, brokerage and related fees. Average Consulting Rates By Industry ; E-Discovery Consultant, $ – $ per hour ; Expert Witness Consultant, $ – $ per hour ; Risk Management Consultant. Their annual fee income can range from anywhere below $50, (R,) a year (for operational support) to above $, (R million for executive. Fee-only financial planning means % objective advice. It's just that simple. When you're making important financial decisions that will affect your future. Let's assume that the average market rate in the US is $50 per hour. A consultancy with just around five years in the business charges $ $30 per hour, while. So your cost on their books was $92k which means that you should at least ask for $44 per hour based on that. However, you are also not working. The average nonprofit consultant fee ranges from $$ per hour. Highly sought consultants can charge upwards of $/hour, while less experienced. 1. Hourly rate. The hourly fee is a common and simple way for independent business consultants and consulting firms to charge. · 2. Daily rate.

Although costs can vary greatly, it is known that they can range from INR 24, per month for an interim consultant working at the operational. Financial consulting fees are typically classified as 'Professional Services'. financial consulting services, including financial planning, investment advice. Financial services and energy sectors might see a 'luxury tax' because By integrating these assessments with daily rates and additional costs, consultants. Your proposal to the client is for a fee of $, (or $25, per month, bringing you $30, in net fees). Fee structure 3: Fixed value-based fees. These. Setting Expectations: Hourly Rates Rates can vary depending on the experience of the advisor and if the advisor has a highly valued area of expertise. The. What is known, though, is that rates can differ widely, from a monthly rate of INR 24, for an interim consultant working on an operational level to INR 1. The estimated total pay for a Financial Consultant is $, per year, with an average salary of $92, per year. These numbers represent the median. The median hourly rate for Business Consultants is $ Hourly rates for Business Consultants on Upwork typically range between $28 and $ Edward Jones Guided Solutions®. Based on your goals and comfort with risk, you and your financial advisor builds and maintains a portfolio within our asset. Standard Consultation Fees for External Clients ; Graduate Student Assistants, $60/hour ; Associate Director, $/hour ; Director, $/hour. Global Functional Specialists – such as Hay Group, Mercer and Willis Towers Watson (focus on HR) or FTI Consulting and Navigant (focus on financial advisory) –. Example: A good rule of thumb is to add 10–20% to your estimated consulting fee to cover unexpected complications. Decide on a pricing model. After you've. Are you wondering if an hourly fee financial advisor is right for you? A growing number of financial advisors work on an hourly basis, with prices ranging. How much do business consultants charge: 7 factors affecting consulting fees financial analysis, you should look for consultants with deep knowledge in that. Financial consultant services cost between $ and $10, annually based on $50, and $1million investment accounts. This price range may also vary. The current industry standard is to charge anywhere from % – 2% of the assets being managed on an annual basis. Most advisors will fall somewhere around the. 1. RESEARCH THE COMPETITION · 2. EXAMINE DIFFERENT CONSULTING FEE STRUCTURES · 3. CALCULATE YOUR HOURLY RATE · 4. CALCULATE PROJECT RATES · 6. ADJUST YOUR FEES FOR. Some consultants might use a daily rate of a thousand dollars, $1,, $2,, $3,, or whatever the number is. As you gain more experience and expertise, you. Fee-Only planners are compensated directly by their clients for advice, plan implementation and for the ongoing management of assets. All NAPFA members are. The average cost (ie, legal fees) for a lawyer to draft a consulting agreement is $ [1] on a flat fee basis.

Ffelp Loans

NCSEAA will transfer its Federal Family Education Loan Program (FFELP) student loan portfolio to Educational Credit Management Corporation (ECMC). With an unsubsidized loan, you—not the government—pay the interest during all periods. Direct Unsubsidized Loans are available to undergraduate and graduate. The program offers four types of loans: Federal Subsidized Stafford Loan, Federal Unsubsidized Stafford Loan, Federal PLUS Loan and the Federal Consolidation. There are two types of federal student loans: Direct and Indirect. Direct Loans are issued by the U.S. Department of Education, while indirect loans are made by. What is a FFEL Program loan? The FFEL Program ended July 1, But you may still have a FFEL Program loan if you were attending school before that date. Default on a Federal Family Education Loan Program (FFELP) Loan occurs when you fail to make payments, and your loan reaches days of delinquency. If your loans show up on your vipcool.ru account and they are from the Art Institute they will be discharged. I was also told to stop making. Payment of special allowance on FFEL loans. § [Reserved]. § , Methods for computing interest benefits and special allowance. While no longer issuing new loans, MFA-SLP continues to provide repayment assistance to existing borrowers of the Federal Family Education Loan (FFELP) and the. NCSEAA will transfer its Federal Family Education Loan Program (FFELP) student loan portfolio to Educational Credit Management Corporation (ECMC). With an unsubsidized loan, you—not the government—pay the interest during all periods. Direct Unsubsidized Loans are available to undergraduate and graduate. The program offers four types of loans: Federal Subsidized Stafford Loan, Federal Unsubsidized Stafford Loan, Federal PLUS Loan and the Federal Consolidation. There are two types of federal student loans: Direct and Indirect. Direct Loans are issued by the U.S. Department of Education, while indirect loans are made by. What is a FFEL Program loan? The FFEL Program ended July 1, But you may still have a FFEL Program loan if you were attending school before that date. Default on a Federal Family Education Loan Program (FFELP) Loan occurs when you fail to make payments, and your loan reaches days of delinquency. If your loans show up on your vipcool.ru account and they are from the Art Institute they will be discharged. I was also told to stop making. Payment of special allowance on FFEL loans. § [Reserved]. § , Methods for computing interest benefits and special allowance. While no longer issuing new loans, MFA-SLP continues to provide repayment assistance to existing borrowers of the Federal Family Education Loan (FFELP) and the.

is your designated guaranty agency for the state of Florida. As the guaranty agency, OSFA has guaranteed Federal Family Education Loans for more than 30 years. Stafford Loans ; A variable rate loan first disbursed on/after 10/1/92 but prior to 7/1/ Borrower had no outstanding balance on FFELP loan when MPN signed. Loan borrowers are available to borrowers with FFELP loans like yours. However, you can gain access to those additional Direct Loan IDR plans if you. Welcome to the new OSLA website for our borrowers. Relief available for FFELP borrowers. Click for more information. If you live in Massachusetts, you can. Learn about consolidating your Federal Family Education Loan Program (FFELP) Loans for the one-time adjustment for IDR and PSLF. The Federal Family Education Loan (FFEL) Program was a program that worked with private lenders to provide education loans guaranteed by the federal. Only federal Direct Loans can be forgiven through PSLF. If you have other federal student loans such as Federal Family Education Loans (FFEL) or Perkins Loans. Federal Family Education Loan Program (FFELP) Repayment Plans · FFELP Subsidized and Unsubsidized Stafford Loans · FFELP Graduate PLUS Loans · FFELP Parent PLUS. FFEL Program Loans into the Direct Loan Program by June 30, (Update: deadline has been extended to June 30, ) Even if your loans have not yet. Loan (FFEL) Program. Since , all new federal student loans are given out directly by the federal government through the Direct Loan Program. But many. The Federal Family Education Loan (FFEL) Program was a system of private student loans which were subsidized and guaranteed by the United States federal. votes, comments. I have $96k in student loan debt between undergrad and grad school. Thanks to Joe Biden, I was just able to. For loans disbursed after April 1, , FFELP Loans effectively only earn at the SAP rate, as the excess interest earned when the borrower rate exceeds the SAP. There are two reasons to consolidate federal student loans: If you have FFEL Loans or Perkins Loans. FFEL and Perkins loans are not forgivable under. «Back The federal government pays the interest on subsidized loans while you're in school as well as during deferment and grace periods. You're responsible. Federal education loans are available through the William D. Ford Federal Direct Loan Program ("Direct Loans"). The Federal Family Education Loan Program. The MDHEWD has administered the Federal Family Education Loan Program (FFELP) in the state of Missouri since Although the federal Healthcare and. No new loans are being made under the FFEL Program. All new loans, and therefore consolidation of those loans, are made under the Direct Loan Program. Federal. ECMC provides support for the administration of the Federal Family Education Loan Program (FFELP) as a student loan guaranty agency. This part governs the following four programs collectively referred to in these regulations as “the Federal Family Education Loan (FFEL) programs,”.

Private Banking Products And Services

Our Products & Services · Personalized Mortgage Services · Private Banking Home Equity Line of Credit · Personal Lines of Credit · Trust and Estate Services. Consumer and commercial banking products and services are offered through CIBC Bank USA. Trust services and investment products are offered by CIBC Private. Wells Fargo Bank, N.A. ("the Bank") offers various banking, advisory, fiduciary and custody products and services, including discretionary portfolio management. The Private Bank is an experience level for qualifying clients of Wells Fargo Wealth and Investment Management (WIM). WIM offers financial products and services. Industry revenue is measured across several distinct product and services lines, including Cash and equivalent assets, Fixed income assets and Equities. Cash. AI continues to be the focus, as more products and services are launched integrated with AI, helping innovation spread to other sectors. Monthly View. Private Banking. Designed for individuals and businesses looking for flexibility in customizing the best products and services for optimum financial success. Your relationship banker will reach out to you periodically to check in on your financial goals and offer advice on any products and services the bank offers. Bank of America Private Bank provides comprehensive wealth management services and customized financing solutions to meet your private banking needs. Our Products & Services · Personalized Mortgage Services · Private Banking Home Equity Line of Credit · Personal Lines of Credit · Trust and Estate Services. Consumer and commercial banking products and services are offered through CIBC Bank USA. Trust services and investment products are offered by CIBC Private. Wells Fargo Bank, N.A. ("the Bank") offers various banking, advisory, fiduciary and custody products and services, including discretionary portfolio management. The Private Bank is an experience level for qualifying clients of Wells Fargo Wealth and Investment Management (WIM). WIM offers financial products and services. Industry revenue is measured across several distinct product and services lines, including Cash and equivalent assets, Fixed income assets and Equities. Cash. AI continues to be the focus, as more products and services are launched integrated with AI, helping innovation spread to other sectors. Monthly View. Private Banking. Designed for individuals and businesses looking for flexibility in customizing the best products and services for optimum financial success. Your relationship banker will reach out to you periodically to check in on your financial goals and offer advice on any products and services the bank offers. Bank of America Private Bank provides comprehensive wealth management services and customized financing solutions to meet your private banking needs.

AI continues to be the focus, as more products and services are launched integrated with AI, helping innovation spread to other sectors. Monthly View. products that coincide with the client's stipulations. Most clients utilizing private banking services open deposit accounts of one kind or another. Receive direct access to premier banking products and services and a dedicated relationship manager linking you to our entire Wealth Management team. We have provided these links for your convenience. However, we do not endorse or guarantee any products or services you may view on other sites. Other websites. Banking products including current accounts, unsecured lending, savings and time deposits, plus our award-winning mobile and online banking propositions. We. Private Banking business and no longer offers private banking or wealth management services. Visit your regional site for more relevant services, products. Your Frost private banker gives you a single point of contact to a full suite of financial products and services. Banking and Lending. We offer a range of. Private Banking provides you with superior banking services, including exclusive accounts products and services offered by its affiliates. Securities. products that coincide with the client's stipulations. Most clients utilizing private banking services open deposit accounts of one kind or another. PNC Bank offers a wide range of personal banking services including checking Investment management and related products and services provided to a. Private banking services from Tech CU offers banking concierge services including coordination and assistance with multiple financial planning needs. personal service, premium banking products and expert advice from a dedicated Private Banker. Our goal is to build and maintain strong, trusted. Consumer and commercial banking products and services are offered through CIBC Bank USA. Trust services and investment products are offered by CIBC Private. Citi Private Bank is dedicated to serving wealthy individuals and families through outstanding private banking services, helping clients preserve & grow. Your relationship banker will reach out to you periodically to check in on your financial goals and offer advice on any products and services the bank offers. Citi Private Bank is dedicated to serving wealthy individuals and families through outstanding private banking services, helping clients preserve & grow. Your banker is ready to connect you to the right products and advisors. Illustration of a financial pie graph. Business Services. You'll also gain exclusive benefits across a variety of financial products and services: Private Banking product and service benefits. You May Also Be. Private Bank. Products and Services. Private Bank. Deutsche Bank's Private Bank corporate division combines the private banking expertise of the Deutsche Bank. Your private banker will get to know you and your unique financial situation, then help you explore the right products and services to help you meet the goals.

What Are Mortgage Rates Expected To Do

While inflation is expected to keep moderating, any unexpected changes in labor market conditions could trigger more mortgage rate volatility as investors. Since the rate is used by most banks as the baseline interest rate, any increases or decreases will cause your adjustable-rate mortgage payments to fluctuate. “The main reason mortgages are expected to gradually decline is the highly anticipated Federal Reserve rate cut expected in September. In fact, the expectation. The Bank of Canada's fastest rate-hike cycle since was endured from March until June , which brought rates from % to %. The cycle lasted. While 30 year fixed mortgages have more to do with how much liquidity is in the mortgage bank securities market. It is unlikely that a. Yeah, the market is thinking rates will be slashed in early Upvote. Against that backdrop, our expectation remains that there will be two additional rate cuts this year, one at each meeting after today's meeting that will lower. On Friday, Sept. 13, , the average interest rate on a year fixed-rate mortgage dropped nine basis points to % APR. The average rate on. However, even when the Fed does start to cut rates, we shouldn't expect a dramatic reduction, according to Jacob Channel, LendingTree's senior economist. While inflation is expected to keep moderating, any unexpected changes in labor market conditions could trigger more mortgage rate volatility as investors. Since the rate is used by most banks as the baseline interest rate, any increases or decreases will cause your adjustable-rate mortgage payments to fluctuate. “The main reason mortgages are expected to gradually decline is the highly anticipated Federal Reserve rate cut expected in September. In fact, the expectation. The Bank of Canada's fastest rate-hike cycle since was endured from March until June , which brought rates from % to %. The cycle lasted. While 30 year fixed mortgages have more to do with how much liquidity is in the mortgage bank securities market. It is unlikely that a. Yeah, the market is thinking rates will be slashed in early Upvote. Against that backdrop, our expectation remains that there will be two additional rate cuts this year, one at each meeting after today's meeting that will lower. On Friday, Sept. 13, , the average interest rate on a year fixed-rate mortgage dropped nine basis points to % APR. The average rate on. However, even when the Fed does start to cut rates, we shouldn't expect a dramatic reduction, according to Jacob Channel, LendingTree's senior economist.

The Fannie Mae Economic & Strategic Research Group offers a forecast of economic trends in the housing and mortgage finance markets If you do not allow these. The short, unsatisfying answer: it depends. Current forecasts don't suggest rates are likely to fall significantly in the near future. That said, high levels of. Very unlikely. Banks set their offered rates in part in response to the official interest rates, but also in part in response to what they perceive is. In the mortgage industry, lower rates mean more business. So I root for them. As an economist, I don't expect rates below % before Mortgage rate forecast for next week (Sept. ) Mortgage interest rates dropped to their lowest level since February The average year fixed rate. Following the August base rate cut, mortgage rates on fixed rate mortgages have been falling as lenders slashed rates. Many experts are predicting one further. The average lender's top tier 30yr fixed rate fell to the lowest level since April last week. That's down more than % over the past 5 months. NEW. There's increasing talk that a bigger cut of % may be in order sometime this year. At the very least, expect a % rate cut at the remaining two BoC rate. We currently have a lower annual inflation rate of between and percent. Accordingly, our forecasts still anticipate falling interest rates at the short. Experts anticipate a “cool-off” period for mortgage rates in the coming year. The Federal Open Market Committee is slated to slash the benchmark interest rate. Today's market data also points towards more short-term upward pressure on mortgage rates, though next week's highly anticipated, highly probably Fed cut looms. Fixed year mortgage rates in the United States averaged percent in the week ending September 6 of Mortgage Rate in the United States is expected. Fixed year mortgage rates in the United States averaged percent in the week ending September 6 of Mortgage Rate in the United States is expected. Why Canadian mortgage rates may be stealthily heading higher. Robert McLister Don't expect mortgage fireworks after Bank of Canada interest rate decision. Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive. do to get a better interest rate. Mortgage rates ping-ponged in May, starting at %, falling to %, and then finishing the month at %. “After a reduction in rates in mid-May—based on. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of September 13 pm EST. The more likely it is you can make your mortgage payments, typically the better interest rate you'll get. What helps determine that? Here are some of the things. Economic conditions. With inflation rising after , it may be unsurprising if lenders raise rates to protect their profit margins, though that's scant.

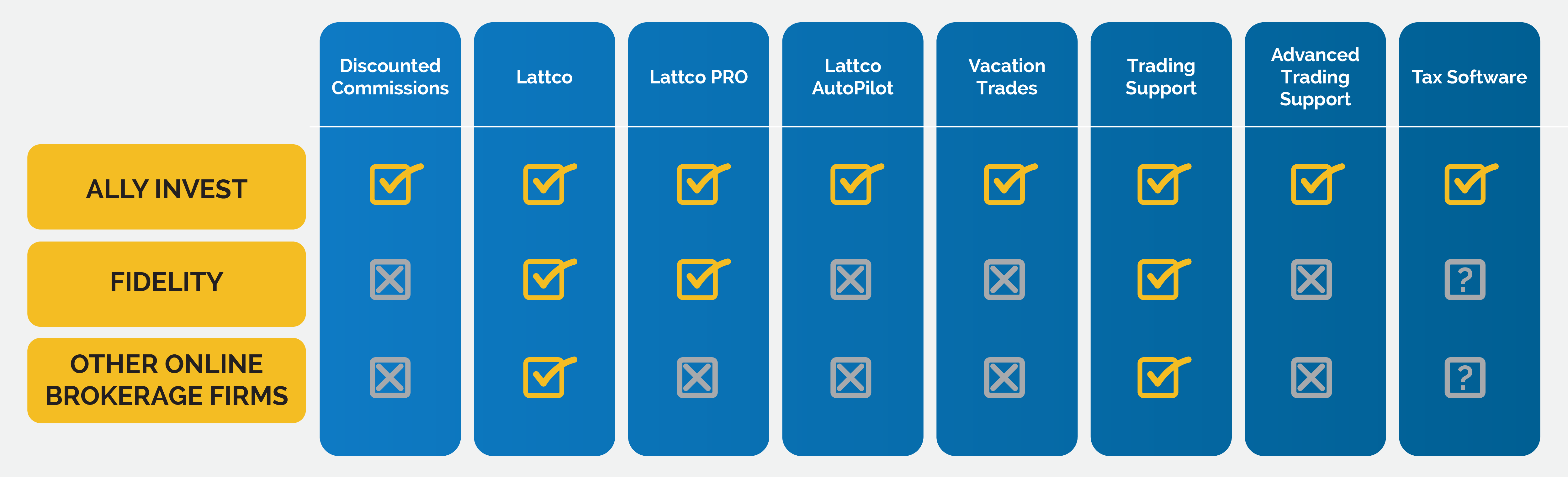

Online Brokerage Account Comparison

Commissions and fees: Fidelity mainly offers accounts with no recurring fees. You won't pay commissions on most trades outside of fixed-income securities and a. A brokerage trading platform is an online platform where individuals and brokerage accounts and margin accounts. What are the Common Features of. The top online brokerage accounts for trading stocks in August · Charles Schwab · Fidelity Investments · Robinhood · E-Trade · Interactive Brokers · Merrill Edge. HOW TO COMPARE ONLINE BROKERS WITH HARDBACON? Before choosing an online broker with our comparison tool, the first step is to determine which type of investor. Best Online Brokerage Accounts and Trading Platforms of · Best Overall: Fidelity · Best for Low Costs: Fidelity · Best for Beginners: Charles Schwab · Best for. E*TRADE from Morgan Stanley charges $0 commission for online US-listed stock, ETF, mutual fund, and options trades. Exclusions may apply and E*TRADE from Morgan. If you're in the market for an online broker, read our reviews to help determine which brokerage account is for you. But brokerage accounts are taxable, unlike IRAs which are either tax-deferred or tax-free and have rules around contribution and withdrawals. What Is an IRA? An. Best online broker overall Fidelity came out on top in three categories – smartphone app, advisory services and fees – but it won second or third place in. Commissions and fees: Fidelity mainly offers accounts with no recurring fees. You won't pay commissions on most trades outside of fixed-income securities and a. A brokerage trading platform is an online platform where individuals and brokerage accounts and margin accounts. What are the Common Features of. The top online brokerage accounts for trading stocks in August · Charles Schwab · Fidelity Investments · Robinhood · E-Trade · Interactive Brokers · Merrill Edge. HOW TO COMPARE ONLINE BROKERS WITH HARDBACON? Before choosing an online broker with our comparison tool, the first step is to determine which type of investor. Best Online Brokerage Accounts and Trading Platforms of · Best Overall: Fidelity · Best for Low Costs: Fidelity · Best for Beginners: Charles Schwab · Best for. E*TRADE from Morgan Stanley charges $0 commission for online US-listed stock, ETF, mutual fund, and options trades. Exclusions may apply and E*TRADE from Morgan. If you're in the market for an online broker, read our reviews to help determine which brokerage account is for you. But brokerage accounts are taxable, unlike IRAs which are either tax-deferred or tax-free and have rules around contribution and withdrawals. What Is an IRA? An. Best online broker overall Fidelity came out on top in three categories – smartphone app, advisory services and fees – but it won second or third place in.

Buy, sell, and trade stocks online with a brokerage account Supporting documentation for any claims, comparison, recommendations, statistics or other. Compare ways to invest at Wells Fargo Advisors - work with a Financial Advisor, Self Directed Online Trading or Digital Investing Plus Advice. Comparison tool; Best performing shares; Watchlist; Trading Central Ready to open an account? Open your online brokerage account in less than 15 minutes. eToro. etoro broker center · Trade $Get $10 ; Axos Invest. axos invest broker center · Earn$ when you maintain a $ Axos® Invest account balance for Consistently ranked among the best online brokers, Fidelity offers powerful trading tools, helpful research, and some of the most competitive pricing in the. Find and compare brokerage accounts, financial advisors, and online brokers on factors like fees, promotions, and features with our online brokerage. Combine that with commission-free trading, and you have a big win for retail traders with accounts above $25, I recently compared ThinkorSwim to several. logo. Charles Schwab. ; logo. Fidelity · ; logo. Interactive Brokers · ; Best for new-to-intermediate investors. logo. Ally Invest. ; Best for options. Read our in-depth reviews of the world's leading online brokerages, compare commissions and features and find the option that best suits your personal. While selecting your preferred brokerage account, consider what you are planning to invest in. If you want to invest in other asset classes such as in currency. Tap on the profile icon to edit your financial details. Got It. Online Brokerage Accounts. Your Details Done. This online brokerage comparison tool helps. Brokerages provide low-to-no fees, user-friendly online brokerage platforms, and educational content to make trading simple – even for the beginning investor. Whether you're a do-it-yourself type, need some guidance or want a unique plan designed by an advisor, we can help you reach your goals and grow your wealth. With brokerage fees, it is the percentage that matters, not the dollar amount. $10 for each of two $1, trades is not better than being charged $20 for a. Active Trader vs. on Bloomberg TV vs. CNBC, but usually within seconds of each other. I'm not always sure which were fresher, but my trades. View our brokerage firms comparison to compare our low cost to other online brokers. AccountSM are service marks and/or trademarks of Interactive Brokers LLC. Compare almost 40 stock trading accounts from more than 20 providers at Australia's biggest financial comparison website* to find an account for you. How I Rank The Best Online Brokers · Vanguard · Charles Schwab · TD Ameritrade · M1 Finance · Betterment · Acorns · Webull · Capital One Invest (formerly Sharebuilder). The pandemic brought millions of new investors, plus supply-chain woes and inflation. All of that's a challenge for online brokerages. Here's our annual ranking. $0 online equity trades reflects our commitment to make investing accessible to everyone. · $0. Listed Stocks. online commission · $0. Options. online commission1.

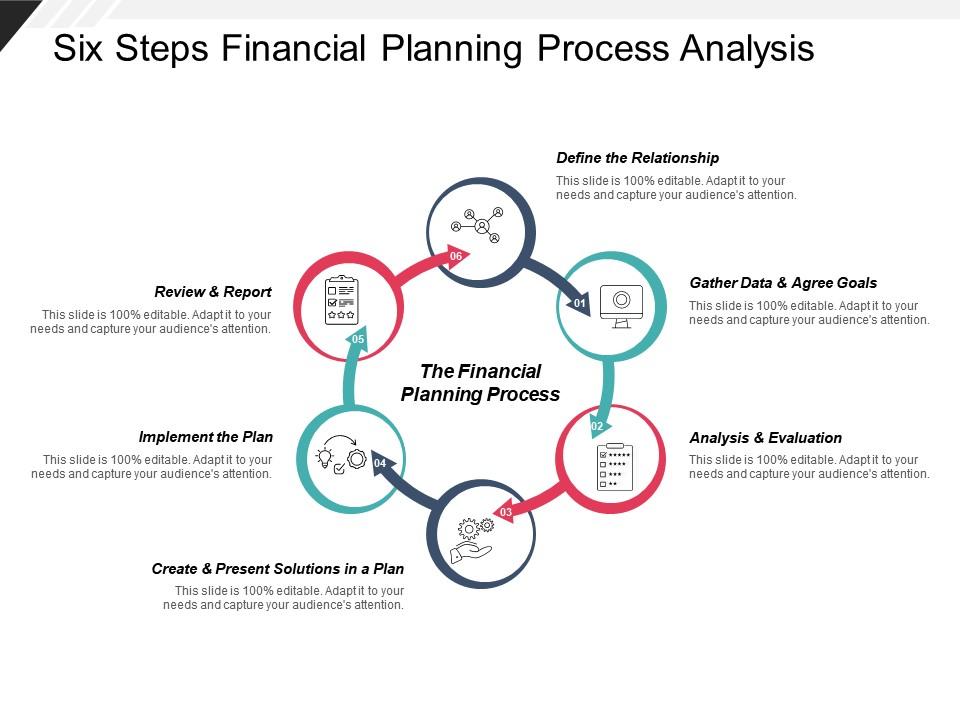

Financial Analysis Process

This type of financial analysis involves looking at various components of the income statement and dividing them by revenue to express them as a percentage. For. Selecting an interest rate to use in a financial analysis can be one of the most difficult steps, usually with no clear-cut right or wrong choice. The second. Financial statement analysis is the process of analyzing a company's financial statements for decision-making purposes. The role of financial statement analysis is to use the financial reports prepared by firms and combine them with other sources of information to decide if you. Financial analysis techniques, including common-size financial statements and ratio analysis, are useful in summarizing financial reporting data. Financial analysis is a process of evaluating the financial performance of a company. It involves analysing financial statements, ratios, and other financial. Financial analysis is the process of examining financial statements and other relevant data to assess the financial health and performance of an organization. An important part of the financial analysis for a merger or acquisition is evaluating the potential synergies between the two companies involved in the. What is the Financial Reporting and Analysis Process? · Leverage a single source of truth · Group audiences by roles or report types · Automate standard reports. This type of financial analysis involves looking at various components of the income statement and dividing them by revenue to express them as a percentage. For. Selecting an interest rate to use in a financial analysis can be one of the most difficult steps, usually with no clear-cut right or wrong choice. The second. Financial statement analysis is the process of analyzing a company's financial statements for decision-making purposes. The role of financial statement analysis is to use the financial reports prepared by firms and combine them with other sources of information to decide if you. Financial analysis techniques, including common-size financial statements and ratio analysis, are useful in summarizing financial reporting data. Financial analysis is a process of evaluating the financial performance of a company. It involves analysing financial statements, ratios, and other financial. Financial analysis is the process of examining financial statements and other relevant data to assess the financial health and performance of an organization. An important part of the financial analysis for a merger or acquisition is evaluating the potential synergies between the two companies involved in the. What is the Financial Reporting and Analysis Process? · Leverage a single source of truth · Group audiences by roles or report types · Automate standard reports.

FINANCIAL STATEMENT ANALYSIS. Financial Statement Analysis (FSA) can also be defined as the process of identifying financial strengths and weaknesses of the. Credit evaluation: Your creditworthiness will be ascertained throughout the financial analysis process, putting you in good stead for banks and other. Financial analysis refers to an assessment of the viability, stability, and profitability of a business, sub-business or project. Financial ratio analysis is a method used by businesses, investors, and analysts to evaluate and interpret financial statements. Financial reporting is an accounting process of communicating an organization's financial performance to internal and external stakeholders. Corporate strategy often seems abstract to managers on the ground, who struggle to translate it into a realistic plan of action. But a process called Save. Financial projection and analysis is an internal process that helps a company explain their most recent earnings and growth (or lack thereof). Learn about financial planning and analysis (FP&A), which is the process of forecasting and analyzing financial data to help businesses make better. Financial analysis is the process of evaluating financial data, trends, and performance indicators to assess the financial health, stability, and profitability. Financial statement analysis (or just financial analysis) is the process of reviewing and analyzing a company's financial statements to make better economic. What is financial analysis? In the corporate world, financial analysis is the systematic process of examining a company's financial statements, budgets, and. This process provides insight into a company's revenue, expenses, assets, liabilities, and equity. Financial reports offer a comprehensive view of a business'. Steps To Analyze Financial Statements · 1. Gather And Review Financial Statements · 2. Calculate Financial Ratios · 3. Compare Ratios And Industry Benchmarks · 4. Under the indirect method of preparing the statement of cash flows, the statement uses the accrual method figures from the income statement and adjusts them up. The financial statement analysis framework is a generic term used to describe the process in which analysts assess financial statements. ➤ Identify and understand the major components of financial statements. ➤ List in order and explain each step in the financial analysis process. ➤ Explain. Financial projection and analysis is an internal process that helps a company explain their most recent earnings and growth (or lack thereof). The three main methods used in financial statement analysis include vertical analysis, horizontal analysis, and ratio analysis. What are examples of financial. Financial analysis involves different tools and techniques such as ratio analysis, trend analysis, cash flow analysis, comparative analysis. With this method of analysis, we will look up and down the income statement (hence, “vertical” analysis) to see how every line item compares to revenue as a.

Compliance Work

When it comes to jobs in the United States, the largest single category of regulatory compliance specialists can be found working in the Federal Government. People considering this profession may have questions about skill requirements for the role, earning potential, and common work settings, or wonder how long it. Compliance officers make sure companies and governing bodies stay in line with internal policies and regulatory requirements. In the financial industry. It's essential for employers subject to US labor and employment law to understand and comply with the five most important laws that relate to job descriptions. Corporate compliance: the actions/policies an organization/business institutes to ensure that everyone within the company complies with both internal and. compliance with ethical or regulatory standards. Sample of reported job titles: Accreditation Lieutenant; Accreditation Manager; Compliance Director; Compliance. New Opportunities for Lawyers Rather, the role of the compliance officer, for example, is to educate and audit, enforce the rules, and foster an ethical work. compliance requirements across the organization. - Developing the annual compliance work plan that reflects the organization's unique characteristics. Compliance officers are responsible for helping the organisation they work for adhere to relevant external statutory and regulatory requirements. When it comes to jobs in the United States, the largest single category of regulatory compliance specialists can be found working in the Federal Government. People considering this profession may have questions about skill requirements for the role, earning potential, and common work settings, or wonder how long it. Compliance officers make sure companies and governing bodies stay in line with internal policies and regulatory requirements. In the financial industry. It's essential for employers subject to US labor and employment law to understand and comply with the five most important laws that relate to job descriptions. Corporate compliance: the actions/policies an organization/business institutes to ensure that everyone within the company complies with both internal and. compliance with ethical or regulatory standards. Sample of reported job titles: Accreditation Lieutenant; Accreditation Manager; Compliance Director; Compliance. New Opportunities for Lawyers Rather, the role of the compliance officer, for example, is to educate and audit, enforce the rules, and foster an ethical work. compliance requirements across the organization. - Developing the annual compliance work plan that reflects the organization's unique characteristics. Compliance officers are responsible for helping the organisation they work for adhere to relevant external statutory and regulatory requirements.

Being a Compliance Officer is a tough gig. As others have said you have to have a solid understanding of the business, have excellent people. As a compliance officer, your job is to help everyone else at your company follow the law. Businesses are subject to a wide range of regulations and guidelines. regulatory compliance jobs in canada · Compliance Administrator · Compliance and Regulatory Legal Counsel - Calgary · Lead Wetland Ecologist · Regulatory. The best way to avoid noncompliance risks is to work with an employer of record who can help you navigate the complex world of Canadian employment law. But more. Compliance officers make sure companies and organizations operate in full compliance with legal regulations and industry-specific guidelines. compliance requirements across the organization. - Developing the annual compliance work plan that reflects the organization's unique characteristics. This Compliance Officer job description template is optimized for posting to online job boards or careers pages and easy to customize for your company. Browse open jobs and land a remote Compliance job today. See detailed job requirements, compensation, duration, employer history, & apply today. How Does Regulatory Compliance Work? In any industry, there are regulations, and organizations operating in those industries must comply with these. Today's top + Compliance jobs in New York, United States. Leverage your professional network, and get hired. New Compliance jobs added daily. Today's top + Compliance jobs in United States. Leverage your professional network, and get hired. New Compliance jobs added daily. Metropolitan areas with the highest concentration of jobs and location quotients in Compliance Officers: Metropolitan area, Employment (1), Employment per. I am interested in learning more about how compliance officers work and how they use AI in their daily job. Any features you don't like or. The U.S. Department of Labor is committed to providing its customers — America's employers, workers, job seekers and retirees — with clear and. Candidates may need one or more years of work experience, a signed ethics statement or ongoing training units gained through live training or events before. Corporate compliance: the actions/policies an organization/business institutes to ensure that everyone within the company complies with both internal and. Most employers require a bachelor's degree for entry-level compliance positions. Your company may be willing to help new employees develop skills through on-the. Compliance Supervision. View All OCC Job Openings. The Office of the Comptroller of the Currency (OCC) has compliance bank examiner/specialist opportunities in. Compliance Works is your go-to resource for HR compliance in Canada. Get expert guidance, tools, and updates to stay ahead in HR laws. 10 Essential Skills Every Compliance Manager Must Have! The compliance manager is like the company's rulekeeper. Their main job is to ensure that the company.

How Much Does It Cost To Refinance A Home

The cost to refinance a mortgage generally adds up to 2% to 6% of the loan amount. This sum covers expenses such as application fees, loan origination fees. Most refinances cost around 2% to 6% of the loan amount. Can I refinance my mortgage with no closing costs? There are some no. On average, homeowners can expect to pay 2% to 3% of the loan amount to refinance a mortgage. Refinancing a $, home loan, for example, may cost $6, to. costs of getting the loan, including points, closing costs and lender fees. Should You Refinance Your Mortgage? Refinancing your mortgage could serve. What will my closing costs be? · Your total estimated closing costs will be $5, · Check PNC's Current Mortgage Rates. Mortgage Refinancing Cost Guidelines. In general, it costs between % of your mortgage's principal to refinance your home. To get a precise estimate of. The cost to refinance a mortgage generally adds up to 2% to 6% of the loan amount. This sum covers expenses such as application fees, loan origination fees. Refinancing Costs ; Loan Info · Interest rate · Must be between % and % ; Taxes & Insurance · Homeowners insurance · Must be between $0 and $1,, It is typically included in the total loan amount to avoid any upfront, out of pocket costs. Expect to pay around % of your principal balance to make up. The cost to refinance a mortgage generally adds up to 2% to 6% of the loan amount. This sum covers expenses such as application fees, loan origination fees. Most refinances cost around 2% to 6% of the loan amount. Can I refinance my mortgage with no closing costs? There are some no. On average, homeowners can expect to pay 2% to 3% of the loan amount to refinance a mortgage. Refinancing a $, home loan, for example, may cost $6, to. costs of getting the loan, including points, closing costs and lender fees. Should You Refinance Your Mortgage? Refinancing your mortgage could serve. What will my closing costs be? · Your total estimated closing costs will be $5, · Check PNC's Current Mortgage Rates. Mortgage Refinancing Cost Guidelines. In general, it costs between % of your mortgage's principal to refinance your home. To get a precise estimate of. The cost to refinance a mortgage generally adds up to 2% to 6% of the loan amount. This sum covers expenses such as application fees, loan origination fees. Refinancing Costs ; Loan Info · Interest rate · Must be between % and % ; Taxes & Insurance · Homeowners insurance · Must be between $0 and $1,, It is typically included in the total loan amount to avoid any upfront, out of pocket costs. Expect to pay around % of your principal balance to make up.

The cost to refinance a mortgage in California will vary from application to application, but generally speaking, you should anticipate paying $2, to $4, Closing costs typically equal about 1 to 4% of your loan amount. For example, if your loan amount is $,, your closing costs could range from $2, to. Remember, there will be closing costs associated with refinancing—typically between 1% to 3% of the amount of the new mortgage. These costs can be paid out of. That cost can range from $$ for an average-sized home, but it may not always be required under all refinance loan programs. There are also generally. First off, refinancing costs money. Usually a few hundred to a few thousand dollars. You might be able to roll that into the new loan, but it. How much does it cost to refinance? There are many options for managing closing costs for different kinds of refinance loans. Regardless of whether or not. Remember, refinancing a mortgage may cost about 2% to 3% of the total loan amount. The average closing cost is around $5,, but it ultimately depends on your. You'll typically pay mortgage refinance closing costs ranging from 2% to 6% of your loan amount, depending on the loan size. National average closing costs for. To begin with, refinancing loans have closing costs just like a regular mortgage. The mortgage lender Freddie Mac suggests budgeting about $5, for closing. Current mortgage refinance news ; % · % · % · % ; % · % · % · %. Interest rates vary depending on the type of mortgage refinance you choose. See the differences and how they can impact your monthly payment. It can cost between 2% and 6% of the loan amount to refinance a conventional loan. These refinances can have higher credit and financial requirements compared. The average cost to refinance a mortgage in the United States typically ranges from 2% to 6% of your loan amount. This means if your outstanding mortgage. Today, the closing costs on a home refinance average $5, (Opens in a new Window), according to The Federal Home Loan Mortgage Corporation, a government-. Closing costs for a mortgage refinance can vary greatly - often between 2% and 5% of the purchase price. Here's how to better expect costs around. A no-closing-cost refinance lets you refinance without paying closing costs upfront. Learn how to refinance without closing costs and when it makes sense to. How much does it cost to refinance? There are many options for managing closing costs for different kinds of refinance loans. Regardless of whether or not. The average APR for a year fixed refinance loan increased to % from % yesterday. This time last week, the year fixed APR was %. Meanwhile, the. It varies by lender, but the overall cost ends up being about two to six percent of your loan amount. So, if you're taking out a $, loan, you may be. Refinance rates valid as of a.m. Pacific Daylight Time and assume borrower has excellent credit (including a credit score of or.

Do You Need A Down Payment To Refinance A Home

:max_bytes(150000):strip_icc()/how-much-do-we-need-as-a-down-payment-to-buy-a-home-1798252_FINAL-d436ccb9c27f4ced9c60c70eb01a4fdb.png)

In most instances, you will not need a down payment when refinancing your car loan. However, there are certain situations when you may need to provide an. Conventional fixed rate mortgages can be used to refinance a home with as little as 3% equity when private mortgage insurance (PMI) is purchased. If you're. Generally speaking, you should have at least 20% equity in your home if you want to refinance. If you want to get rid of private mortgage insurance (PMI), you'. How much equity you have in your home – the more the better. · Your credit score – higher scores can get lower interest rates · Your debt-to-income ratio – how. In exchange for a higher interest rate on your loan, your lender will give you credits to cover your upfront closing costs. The second is by applying your. 3% equity option. If you already have a Fannie Mae-owned loan, you can refinance with as little as 3% equity. · Co-borrower flexibility. Not all borrowers have. USDA loans don't require any down payment, but do require an upfront and annual guarantee fee that you'll pay for the loan's duration. Conventional loans only. Refinancing costs are similar to those paid when you purchased your home, including a loan origination fee. There are required services involved, as well as. Many homeowners use cash-out refinances to get the funds they need for a down payment on a new property or buy a new home in cash if they have enough equity. In most instances, you will not need a down payment when refinancing your car loan. However, there are certain situations when you may need to provide an. Conventional fixed rate mortgages can be used to refinance a home with as little as 3% equity when private mortgage insurance (PMI) is purchased. If you're. Generally speaking, you should have at least 20% equity in your home if you want to refinance. If you want to get rid of private mortgage insurance (PMI), you'. How much equity you have in your home – the more the better. · Your credit score – higher scores can get lower interest rates · Your debt-to-income ratio – how. In exchange for a higher interest rate on your loan, your lender will give you credits to cover your upfront closing costs. The second is by applying your. 3% equity option. If you already have a Fannie Mae-owned loan, you can refinance with as little as 3% equity. · Co-borrower flexibility. Not all borrowers have. USDA loans don't require any down payment, but do require an upfront and annual guarantee fee that you'll pay for the loan's duration. Conventional loans only. Refinancing costs are similar to those paid when you purchased your home, including a loan origination fee. There are required services involved, as well as. Many homeowners use cash-out refinances to get the funds they need for a down payment on a new property or buy a new home in cash if they have enough equity.

With a cash-out refinance, you're refinancing your mortgage for more than you currently owe. In return, you're getting a portion of your equity back in cash. In some cases, you might even be able to purchase a home with zero down. How much down payment you'll need for a house depends on the loan you get. While there. But lenders will charge you fees to refinance, just as they did when you got your initial loan. Here's what you need to know if you're considering whether a. Financing to cover up to 20% down payment and up to 5% closing costs. Loan amounts up to $50, for homes located in High or Very High Opportunity Areas (per. At least 20% equity will make it easier to qualify for a loan. Check to make sure that you have a credit score of about or higher and a debt-to-income (DTI). When you buy a house, you usually have to also make a down payment. The down payment requirement is equal to a percentage of the cost of the property and can. Did you make a small down payment when you purchased your home and now find yourself paying for private mortgage insurance (PMI)? If your equity level has. If you have available equity in your home, you may be able to get cash at closing with a cash-out refinance loan. Explore cash-out refinance loans. Mortgage options for low down payments Here are some common types of loans that offer low-down-payment options. First time homebuyers might qualify for a. require a down payment we have a mortgage to fit your needs. View equity in their home but would like to refinance to take cash out. Usually, you will need this if you get a loan with a down payment of less than 20% of the home's value. However, did you know that when you make enough payments. Fees can range between $$ a month. If the home you buy is in a homeowners or condo association, you will have to pay a monthly fee for things like. The cost to refinance a mortgage ranges from 2% to 6% of your loan amount, and you can expect to pay less to close on a refinance than on a comparable purchase. You want to cash out too much equity. When you do a cash-out refinance, lenders require you to retain a certain amount of equity in your home, often 20%, to. Lenders may require PMI coverage for a certain length of time or until the buyer has built 20% equity in their home. You may also qualify for a refinance loan. Down payments are not an actual necessity. But there will be costs associated with your mortgage loan when you refinance. Be open and discuss with your lender. Downpayment and Closing Cost Loan options – up to $18, available! Minimum credit score requirement; Owner-occupancy required. Downpayment and. It is wrapped into your main home mortgage, so you don't have two bills to pay. you sell, transfer, move out of or refinance the property. You have a. Usually paid as a monthly premium, PMI is a type of insurance that helps protect the lender in the event you're unable to keep up with your mortgage payments. Cash-out refinance pays off your existing first mortgage. This results in a new mortgage loan which may have different terms than your original loan.

Equity Mutual Funds Sip

Moneycontrol provides you the complete guide for top ranked funds and best equity funds to buy/invest, best equity mutual funds in India, best performing. List of Best SIP Funds in India sorted by Returns ; Quant Active Fund · ₹11, Crs ; Quant Large and Mid Cap Fund · ₹3, Crs ; Quant Focused Fund · ₹1, Crs. A SIP calculator is a tool that helps you determine the returns you can avail when parking your funds in such investment tools. Systematic Investment Plan or. However, there is ample data to validate that the SIP returns from an equity mutual fund scheme outperform the returns from a fixed income instrument by a wide. A SIP is a systematic approach to investing and involves allocating a small pre-determined amount of money for investment in the market at regular intervals. It's easy to start a SIP online following a few simple steps, start by visiting the website of the Fund House. Register a new account and select the fund you. A Systematic Investment Plan (SIP) is an investment tool which allows the investor to invest a fixed amount at regular intervals in a Mutual Fund scheme. SIP. What is Systematic Investment Plan (SIP)? A systematic investment plan is a disciplined approach to investing in mutual funds. SIPs offer a disciplined and. You can invest in mutual funds either in lump sum or through SIP. Lump sum is one time investment while SIP is staggered investment wherein you can invest a. Moneycontrol provides you the complete guide for top ranked funds and best equity funds to buy/invest, best equity mutual funds in India, best performing. List of Best SIP Funds in India sorted by Returns ; Quant Active Fund · ₹11, Crs ; Quant Large and Mid Cap Fund · ₹3, Crs ; Quant Focused Fund · ₹1, Crs. A SIP calculator is a tool that helps you determine the returns you can avail when parking your funds in such investment tools. Systematic Investment Plan or. However, there is ample data to validate that the SIP returns from an equity mutual fund scheme outperform the returns from a fixed income instrument by a wide. A SIP is a systematic approach to investing and involves allocating a small pre-determined amount of money for investment in the market at regular intervals. It's easy to start a SIP online following a few simple steps, start by visiting the website of the Fund House. Register a new account and select the fund you. A Systematic Investment Plan (SIP) is an investment tool which allows the investor to invest a fixed amount at regular intervals in a Mutual Fund scheme. SIP. What is Systematic Investment Plan (SIP)? A systematic investment plan is a disciplined approach to investing in mutual funds. SIPs offer a disciplined and. You can invest in mutual funds either in lump sum or through SIP. Lump sum is one time investment while SIP is staggered investment wherein you can invest a.

Understanding SIP Investment - Systematic Investment Plan. Systematic Investment Plan (SIP) is a mode of investment that allows you to invest a certain sum in. Equity funds invest in the stock markets. They are an ideal solution for those who are looking for capital appreciation and are willing to stay invested for. A systematic investment plan (SIP) is a plan in which investors make regular, equal payments into a mutual fund, trading account, or retirement account such. A SIP calculator is a simple tool that allows individuals to get an idea of the returns on their mutual fund investments made through SIP. Systematic Investment Plans or SIPs are one of the most popular ways of investing in Mutual Funds. SIPs help inculcate financial discipline and build wealth. As the name suggests, through a mutual fund SIP you can invest systematically over a period of time and create a corpus to meet your different financial goals. SIP is a very convenient method of investing in mutual funds through standing instructions to debit your bank account every month, without the hassle of having. HDFC Mutual Fund is the leading mutual fund investment company in India. Explore and invest in wide range of mutual funds with us. A Systematic Investment Plan (SIP) calculator is an online financial tool that can help to calculate the returns you would earn on your SIP investments. Portfolio Manager · Best Mutual Funds · Compare Mutual Funds · SIP Return Calculator · New Fund Offers · Best Stocks Selector · Tax Saver Investment Calculator. Systematic Investment Plan (SIP) is an investment route offered by Mutual Funds wherein one can invest a fixed amount in a Mutual Fund scheme at regular. Compare Latest SIP Returns of all the mutual funds in the large cap fund,large cap category. Use this tool to compare these funds on multiple parameters. What are mutual funds? A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds. What is SIP investment in mutual funds? SIP is a method of investing a fixed amount, regularly – monthly or quarterly in a mutual fund scheme chosen by you. An. Equity; Hybrid; Debt; Solution Oriented; Others. Filter · Equity · Hybrid · Debt · Solution Oriented · Others. Curated choices ; ICICI Prudential. Business Cycle Fund. Regular - Growth. Equity Funds. Sectoral Thematic · %. As on Aug ; ICICI Prudential. Mutual Fund SIP Returns · vipcool.ru Asset Emerging Bluechip Fund Rs · vipcool.ruin India Equity Fund Rs · vipcool.rul Oswal Multicap 35 Fund Rs. · vipcool.ru A mutual fund is a portfolio of stocks, bonds, or other securities purchased with the pooled capital of investors. Mutual funds give individual investors access. UTI Mutual Fund is one of the leading asset management companies in India. Learn about mutual funds, NAV, SIP, etc. and invest in mutual fund schemes. A systematic investment plan (SIP) is a method of investing in mutual funds, where a fixed amount is invested at regular intervals. Mutual funds, on the.